Verwalter von Kollektivvermögen

Themis, Göttin der Gerechtigkeit und Gleichheit – Werte, die unser Handeln bestimmen.

Diese Werte bilden das Fundament, um das sich Themis Capital et Themis Real Estate SICAV vereinen : ein Team aus Experten in den Sparten Immobilien, Private Equity und Asset Management.

Aus diesem vereinten Fachwissen ist auch die treibende Kraft für die Entwicklung eines neuen Immobilienkonzeptes entstanden, das wir ausbauen und teilen möchten – ein Wunsch, dem die Idee entsprungen ist, eine Immobilien-SICAV und einen Verwalter von Kollektivvermögen zu gründen.

Aktivitäten

Vermögensverwaltung

Ziel von Themis Capital SA ist es, kollektive Anlageprodukte im Immobilienbereich zu verwalten. Das erste dieser Produkte ist Themis Real Estate SICAV. In Zukunft können weitere kollektive Anlageprodukte geschaffen werden. Die Gesellschaft kann auch Immobilienportfolios oder kollektive Immobilienanlagen für Dritte in Form von white labelling verwalten.

Immobilienportfolios

Die für die Verwaltung der Themis Real Estate SICAV vereinten Kompetenzen werden auch Immobilieneigentümern zur Verfügung gestellt, die die Verwaltung ihres Portfolios delegieren möchten. Das dynamische und proaktive Management von Themis Capital SA sowie die Skaleneffekte, die durch die Verwaltung großer Volumina möglich sind, ermöglichen es den Eigentümern, die Erträge und den Wert ihrer Immobilien zu optimieren.

Immobilienentwicklung

Themis Capital SA vereint alle Kompetenzen, um Bauprojekte umzusetzen und zu verwalten, die zusätzliche Renditechancen für Investoren bieten können.

.

Investieren, um zu wachsen

Das Team von Themis Capital SA

Laurent Breit

CEO / CPO

Chief Executive Officer

Chief Property Officer

Christophe Lanz

Verwalter

Philippe Craninx

Office Manager OM

Alain Kratzer

Buchhaltung und Finanzen

Alexandra Audemars

Assistentin der Geschäftsleitung

Enrico Antonelli

Advisor

Abderrazag Chafrouda

Economist Analysis – Asset Managment

Themis Real Estate SICAV

Themis Real Estate SICAV ist eine Immobilien-SICAV nach Schweizer Recht, die von Themis Capital SA verwaltet wird und deren Ziel die direkte und nachhaltige Investition in Wohn- und Mischimmobilien in der Schweiz ist.

Eine SICAV ist eine Investmentgesellschaft mit variablem Kapital. Sie ist ein Anlagevehikel, das den Anlegern den Status von Aktionären verleiht. Die investierenden Aktionäre haben daher ein Mitsprache- und Stimmrecht bei der Hauptversammlung und können den Geschäftsverlauf beeinflussen. Diesen aktiven und partizipativen Aspekt, der bei einem Investmentfonds nicht gegeben ist, wollten wir in unseren Beziehungen zu den Anlegern in den Vordergrund stellen.

Neben den Anlegern stehen die Fondsleitung CACEIS (Switzerland) SA , Nyon; die Depotbank CACEIS Bank, Montrouge, Zweigniederlassung Nyon, Schweiz sowie die kollektive Vermögensverwalterin Themis Capital SA in Lausanne, die gegenüber den Anlegern vollumfänglich haftbar sind.

Bisher sind von den 74 von der FINMA zugelassenen Immobilienfonds nur 14 in Form einer SICAV gegründet worden. Themis Real Estate SICAV ist von der FINMA zugelassen und reguliert, ebenso wie ihr Manager Themis Capital SA.

Vorteilhafte Besteuerung

Die von den (in der Schweiz ansässigen) Investoren gehaltenen Aktien werden nicht als Vermögen versteuert und unterliegen auch nicht der Verrechnungssteuer.

Risikokontrolle

Das Immobilienvermögen ist diversifiziert und die SICAV wird von der FINMA reguliert, ebenso wie der Fondsmanager Themis Capital SA.

Kein Agio

In der Startphase hat die Aktie im Gegensatz zu börsennotierten Fonds kein Agio.

Die Philosophie von Themis Capital

Durch Antizipation, Proaktivität und den intelligenten Einsatz digitaler Werkzeuge (Prop Tech) bringen wir einen unternehmerischen und disruptiven Ansatz in die Immobilienverwaltung ein und gleichen die Interessen von Eigentümern und Mietern aus.

Durch die digitale Verwaltung des Immobilienbestands können wir die Konsolidierung von Daten aus verschiedenen Quellen (Hausverwaltungen, Gutachter, Ingenieure, Architekten) automatisieren. Wir steuern die Verwaltung des Immobilienbestands (Überwachung der Budgets für Instandhaltung und Renovierung, Kontrolle der Anwendung der Mietpreispolitik, Rechtsstreitigkeiten usw.).

Unsere Partner sind innovativ und konzentrieren sich auf die CO2-Belastung und die Reduzierung des Energieverbrauchs.

Partner von Themis Capital AG

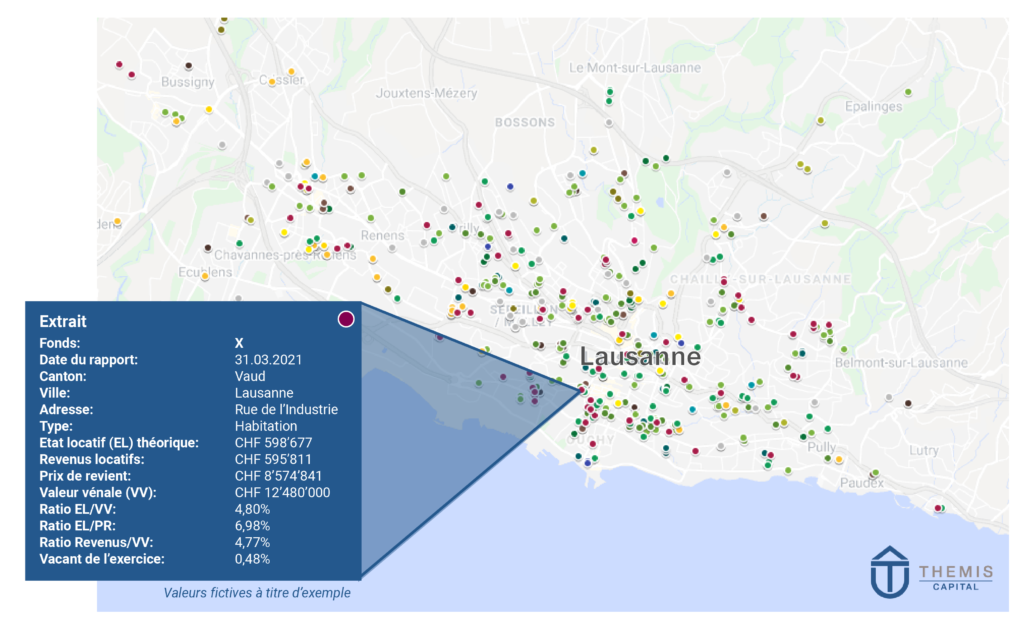

Themis Fund Property Benchmark (TFPB)

Innerhalb von Themis Capital haben wir eine interne Benchmark entwickelt, die aus über 2000 Immobilien (von 24 Immobilienfonds/SICAV) besteht, die sich in der Schweiz befinden, mit u.a. folgenden Informationen:

Aktive Verwaltung

Die Immobilien werden aktiv verwaltet, um sowohl ihre Attraktivität zu steigern und die Mieter zu binden als auch ihren Wert für die Investoren langfristig zu steigern, indem die Immobilien gewartet, renoviert oder funktional und energetisch angepasst werden. Generell wird ein proaktiver nachhaltiger Ansatz verfolgt, um Umwelt- und Sozialaspekte in alle Prozesse zu integrieren. Themis Capital SA beabsichtigt, die Fernverwaltungswerkzeuge von Prop Tech in vollem Umfang zu nutzen. Dank der Installationen vor Ort werden wir den Verbrauch und die Lebensdauer der Objekte genauestens verfolgen, aber auch zukünftige Investitionen antizipieren können.

In nachhaltige Immobilien investieren

Energetische Renovierung

Etwa 80% des Gebäudebestands in der Schweiz haben einen energetischen Sanierungsbedarf. Darüber hinaus werden noch immer über 60% der Haushalte in der Schweiz mit fossilen Brennstoffen beheizt.

Auf der Grundlage des Pariser Abkommens (Halbierung der Treibhausgasemissionen) hat der Bundesrat im August 2019 beschlossen, ab 2050 CO2-Neutralität zu erreichen. Im Rahmen der Totalrevision des CO2-Gesetzes müssen die Kantone dafür sorgen, dass die Emissionen von Gebäuden bis 2026-2027 um 50% unter dem Niveau von 1990 liegen. Diese Bemühungen sowie die Maßnahmen des vollständig revidierten CO2-Gesetzes haben das Potenzial, bis 2030 zu einer Senkung der Emissionen um rund 65 % gegenüber 1990 zu führen.

Die Umsetzung der neuen Energiepolitik stellt private und institutionelle Hausbesitzer vor eine größere Aufgabe. Konkrete, weniger energieintensive Maßnahmen für ältere Gebäude, insbesondere in Stadtzentren, erfordern fundiertes Fachwissen sowie eine pragmatische Bewertung der einzelnen Umsetzungen. Energetische Verbesserungen und Lösungen sowie die Unterstützung durch externe Experten sind ebenfalls sehr kostspielig.

Themis strebt die bestmögliche Energieeffizienz für alle alten Gebäude an.

Die Verbesserungen werden innerhalb von 3 bis 5 Jahren erreicht. Sowohl der CO2-Ausstoß als auch der Ressourcenverbrauch werden auf das niedrigste mögliche Niveau gesenkt. Das Themis-Immobilienportfolio wird somit durch die energetische Verbesserung von Altbauten nachhaltig renoviert. Es ist klar, dass eines der Hauptziele des Fonds darin besteht, einer der wichtigsten Akteure in der Fondsbranche in Bezug auf die energetische Optimierung von Altbauten zu sein. Dies erfordert eine eher langfristige Ausrichtung, jedoch mit einer kontinuierlichen Wertsteigerung.

Vernetzte Vegetation in unseren Büros

Wir freuen uns, vom Pflanzenkonzept von Oxygen at Work profitieren zu können, das vom Bundesamt für Umwelt als nachhaltige Lösung zur Erreichung der Schweizer CO2-Ziele anerkannt wird.

Dieses System reduziert den Stromverbrauch der Lüftungsanlage um 969 kWh pro Jahr, gleicht jedes Jahr CO2-Emissionen in Höhe von 177 kg aus und pflanzt für jede Pflanze im Büro zwei Bäume im Regenwald. In unserem Fall wären das 24 Bäume.

News

Lancierung – Themis Real Estate SICAV vom 20.09.2023 bis 31.10.2023

Die Themis Real Estate SICAV, eine kollektive Anlage nach Schweizer Recht, wird am 20.September2023 mit einem Zielvolumen von CHF 50 bis 60 Millionen lanciert. Die Zeichnungsfrist läuft vom 20. September bis zum 31. Oktober 2023 (Liberierung am 3. November 2023). Das aufgenommene Kapital dient zum Erwerb von neun bestehenden Objekten – mehrheitlich Wohnimmobilien und in…

Die Vorteile der indirekten Immobilienanlage

Yann Tavernier, CEO und Gründer von Themis Capital SA Indirekte Immobilien reduzieren das Risiko und bieten erhebliche Steuervorteile Viele Immobilieneigentümer sind mit den Problemen der Verwaltung, der Instandhaltung, der Überwachung der Verwaltung und den Auswirkungen der Besteuerung auf die Erträge ihrer Investition vertraut, die in einer Welt mit praktisch Nullzinsen immer geringer werden. Jeder Eigentümer…