The management of real estate portfolios on behalf of large private and institutional owners requires extensive expertise in asset management, valuation and energy efficiency.

A forward-looking vision with a good management strategy for the short, medium and long term, allowing for continuous monitoring and improvement of possibilities and efficiency in terms of management and investment optimization.

The various properties are periodically analyzed and subjected to forward-looking reviews as to their medium and long-term potential. Active portfolio management by Themis Capital ensures that the value of the overall portfolio is maintained and that it performs at all times.

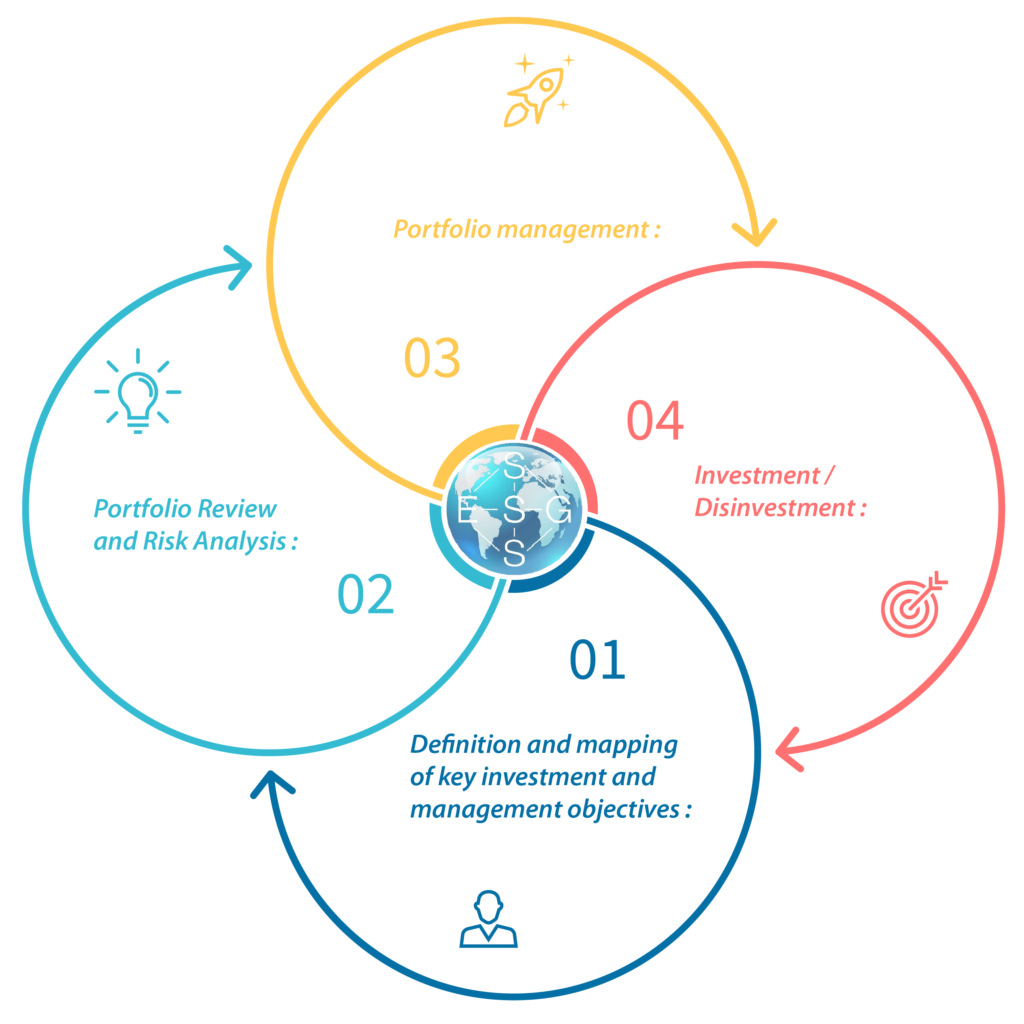

Process

Portfolio management process

Definition and mapping of key investment and management objectives

Portfolio review and risk analysis

Portfolio management

Investment / Divestment

Rental management is carried out by the selected agencies. We set up with them the automation of the accounting entries of the buildings, data exchange procedures.