Collective asset manager

Themis, the goddess of justice and equity, symbolises the values of our business. Themis Capital and bring together a team of real estate, private equity and asset management professionals.

Our specialities have led us to develop a vision of real estate that we wish to share and that requires investment on a larger scale. This is how the idea of creating a real estate SICAV and a collective asset manager came about.

Activities

Asset management

Themis Capital SA aims to manage collective real estate investment products.

The company may also manage real estate portfolios or collective real estate investments for third-party account in the form of white labelling.

Real Estate Portfolios

The real estate property owners who would like to delegate the management of their portfolio can take advantage of the skills of Themis Capital SA.

The dynamic and proactive management of Themis Capital SA as well as possible economies of scale thanks to the management of significant volumes permits owners to optimise the revenues and increase the value of their real estate properties.

Real estate development

Themis Capital SA brings together the skills and capacities to implement and manage construction projects, which can bring opportunities for additional return for investors.

.

Invest to grow

Themis Capital SA’s Team

Laurent Breit

CEO

Chief Executive Officer

Patrick Fierobe

CPO

Chief Property Officer

Christophe Lanz

Administrator

Philippe Craninx

Office Manager OM

Alain Kratzer

Accounting & Finance

Alexandra Audemars

Executive Assistant

Enrico Antonelli

Advisor

Themis Capital’s Philosophy

Through anticipation, proactivity and the intelligent use of digital tools (Prop Tech), we bring an entrepreneurial and disruptive approach to the property management business, rebalancing the interests of owners and tenants.

Through digital property management, we can automate the consolidation of data from different sources (property managers, experts, engineers, architects). We monitor the management of the property portfolio (follow-up of maintenance and renovation budgets, control of the application of the rent policy, litigation, etc.).

Our partners are innovative and focused on the CO2 impact and the reduction of energy consumption.

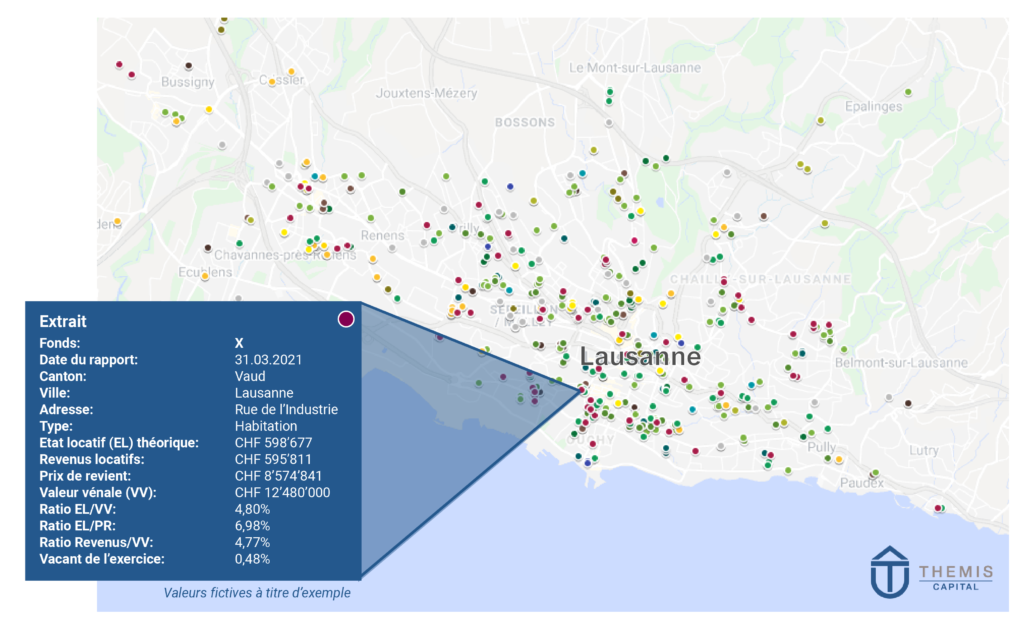

Themis Fund Property Benchmark (TFPB)

Within Themis Capital, we have developed an internal benchmark of over 2000 properties (from 24 real estate funds/SICAVs) located in Switzerland with the following information:

Active real estate management

Active management of the properties is implemented to improve their attractiveness and retain tenants, and to increase their long-term value for investors, through maintenance, renovation or adaptation of the properties in terms of function and energy. In general, a proactive sustainable approach is implemented to integrate environmental and social aspects into all processes. Themis Capital SA intends to make maximum use of the remote management tools of Prop Tech. Thanks to on-site installations, we will be able to monitor consumption and the life of objects as closely as possible, but also to anticipate future investments.

Investing in sustainable real estate

Energy renovation

About 80% of the Swiss building stock is in need of energy renovation. In addition, over 60% of households in Switzerland are still heated with fossil fuels.

On the basis of the Paris Agreements (halving greenhouse gas emissions), the Federal Council decided in August 2019 to achieve CO2 neutrality from 2050. As part of the comprehensive revision of the CO2 Act, the cantons must ensure that emissions from buildings are 50% below 1990 levels by 2026-2027. These efforts, together with the measures provided for in the fully revised CO2 Act, have the potential to bring about a reduction in emissions of around 65% by 2030 compared to 1990.

The implementation of the new energy policy places a greater burden on private and institutional owners. Concrete, energy-saving measures for older buildings, especially in city centres, require in-depth specialist knowledge and a pragmatic assessment of individual implementations. Energy improvements and solutions as well as the support of external experts are also very expensive.

Themis Capital strives to achieve the best possible energy efficiency for all old buildings.

The improvements will be achieved within 3 to 5 years. CO2 emissions and resource consumption will be reduced to the lowest possible level. The Themis real estate portfolio is thus renovated in a sustainable manner through energy improvements to older buildings. It is clear that one of the main goals of the fund is to be one of the leading players in the fund industry with regard to the energy optimisation of older buildings. This requires a rather long-term focus, but with a continuous increase in value.

Connected vegetation in our office

We are pleased to benefit from Oxygen at Work‘s plant-based concept, which is recognised by the Federal Office for the Environment as a sustainable solution for achieving Switzerland’s CO2 targets.

The system reduces the electricity consumption of the ventilation system by 969 kWh per year, offsets 177 kg of CO2 emissions per year, and plants two trees in the rainforest for every plant in the office. In our case, that would be 24 trees.

News

No posts